Your Primary Home is a Liability!

Nov 07, 2022

The title of this article can be a little shocking. If you are anything like me, you were told something alone the lines of "Your personal home is your greatest asset." A recent survey by AAG conducted that 73% of seniors answered "Yes" when asked if their home was considered their most valuable asset. What if I told you that your personal home is also your greatest liability.

A liability is defined as an obligation bewtween one party and another not yet completed or paid for.

Over 50% of people in the United States do not own their homes outright. This means they carry a mortgage.

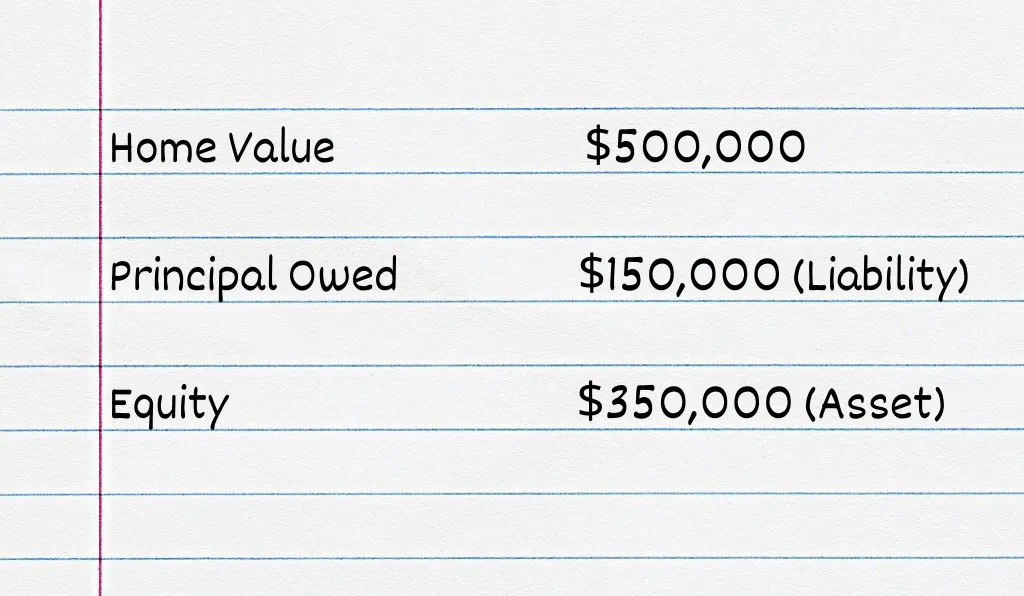

Let's explore how this works:

What this example shows is that although you have been able to accumulate $350,000 of wealth in your home (your greatest asset), you still owe $150,000 (your greatest liability).

The idea that the place where you live, and many plan to stay forever is a liability is not something we like to hear. We were taught to work hard, pay off our homes, save what we can and hope that what we saved plus social security (a topic for a different article), would allow us to reture with some semblance of comfort.

The problem is, if you stop paying you mortgage, we all know what will happen.

You could lose it all.

This thought will send shivers down anyone's spine. During the 2008 housing crisis, there was massive amounts of foreclosures. This is not because people had massive amounts of equity in their homes, which many people did, it came tumbling down, because people could not cover their liabilities (principal owed). Your home is your biggest liability because it does not generate any money.

Assets are defined as property owned by a person or company that are regarded as having value and that can be used to pay off obligations, debts, or legacies.

This is why we see that benefit of making your home an asset. Below, we discuss just a few of the ways that you can turn your biggest liability into an income producing asset.

Unleash the Equity in Your Primary Home

By taking out a loan against the equity in your home, you can buy another asset. Make sure you are using this equity to buy a cash producing asset so you can contribute to the mortgage plus the line of equity you took out. You are simply making your situation worse if you borrow money to purchase more liabilities. There are many banks and businesses that can help with a Home Equity Line of Credit or HELOC. We have seen, first hand, the success with taking out a HELOC and using it to purchase more cash flowing properties. These properties create more wealth and pay down the mortgage on our primary home.

Make Money Renting It

Any area of the home could by rented out as temporary storage or an office. You can rent out portions of your house to film a commercial or a movie. Addtionally, you can rent it out for parking and events. You can rent out rooms to others or turn your house into an apartment for visitors. This is called House-Hacking. Some people use a portion of their home to rent to people on AirBmB or VRBO. Make sure the rent is at least enough to pay for the mortgage

Start a Home-Based Business

You can turn a portion of uour house into an addition to your business or home office. By doing this, you can save the money you would have spent on office rent. Ensure that you charge a price for you goods or services that puts money in your bank account. You are also able to write off a portion of your home and utilities as a business expense which helps bring down your liability. It goes without saying, but I'll say it...Consult Your CPA.

While ther are other ways people have made their homes generate income for themselves, the point of this article is to help you think like an investor, not a consumer. We need to open our eyes to the realites of the market. In doing so, we understand how to better position ourselves and future generations for wealth creation. We do that by taking time to learn on our own, or better yet, finding someone or a group of people who can help us along our journey, and in the end, help us build our First Fen Foundations.

Bryan Escudero

President and Co-Founder, First Gen Foundations

Proud to be a First Gen Investor

Related Articles

4 Key Metrics In Real Estate

Demystify the metrics - we want you to be familiar with when analyzing a real estate deal.

Why Am I Afraid of Investing in Real Estate

Let’s shake off the fear and start creating some action in our investment journey!

Who's In Your Corner

Our goal is to give you a community. Together we can take steps into fearful places and turn it into a opportunity to learn and grow.

CONTACT US

Mailing Address

P.O. BOX 650997 Miami, Florida 33265-0997

Schedule A Call

Email

Phone

(786) 519-3638

Connect With Us!

First Gen Foundations